Your Accounting Advantage

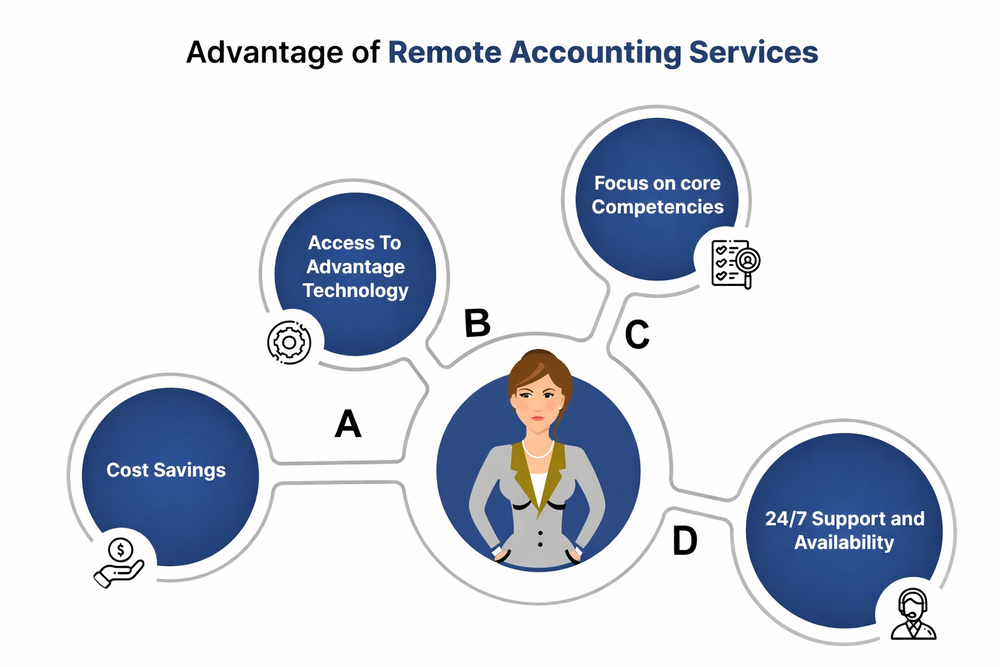

At Laser Pay Check Co., we go beyond basic bookkeeping. Our accounting services are designed to give you clarity, compliance, and confidence in every financial decision. With over 35 years of expertise, we combine precision with personalized support.

- Tailored solutions for startups, partnerships, and corporations

- Transparent reporting for smarter business decisions

- Dedicated advisors available year‑round